Misfiled Tax Help

Minnesota State Mankato partnered with Sprintax to assist you with filing your taxes. If you are not considered a resident for tax purposes and filed using TurboTax or another tax filing service using Form 1040, you must amend your tax return.

The information provides helpful steps you can take to ensure you do this properly.

- Recorded Webinar: Sprintax Webinar Recording on the Stimulus Payment and Amended Returns

- Blog on navigating the stimulus payment

- Blog on Amended Returns

- Website/email content outlined below to share eligibility for the stimulus payment, key areas of confusion, Misfiling as a resident by mistake, recommended next steps, and potential future implications

Stimulus Payment Information

1. Summary of those eligible for the Economic Impact Payment:

- US Residents for tax purposes

- Adjusted Gross Income between $75,000 and $99,000 (increasing for the head of household and married filing jointly)

- Valid social security number

- Not claimed as dependent on someone else’s return

For more information, visit the IRS Economic Impact Payment pages:

- https://www.irs.gov/coronavirus/economic-impact-payment-information-center

- https://www.irs.gov/coronavirus/economic-impact-payments

2. Key area of confusion for international students and scholars: Resident v Nonresident for tax purposes

- Based on IRS Substantial Presence Rule – Most international students and scholars in the US are nonresidents in the US for tax purposes (https://www.irs.gov/individuals/international-taxpayers/substantial-presence-test)

- A small number may be here long enough to be considered tax residents by IRS

3. Misfiling and filing as a resident by mistake

- A significant number of international students and scholars make the mistake of filing as a resident for tax purposes

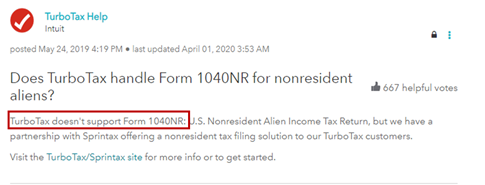

- Most tax services (Turbotax, H&R Block, Tax Act, local CPA, etc – are designed to help residents – not nonresidents – not international students and scholars)

- Filing incorrectly means you are claiming benefits and deductions you are not entitled to

- TurboTax specifically say they cannot help nonresidents

4. Recommended next steps:

1. If you have received the Economic Impact Payment (stimulus check):

- Check what tax return you prepared in 2018 or 2019

- Was it 1040 (for residents) or a 1040NR (for nonresidents)?

- If it was 1040 you filed as a resident for that year.

2. Log in to Sprintax

3. Sprintax will guide you through the substantial presence test and confirm if you were a resident or nonresident for that tax year

Complete the Substantial Presence Test for free with Sprintax

4. If you filed as a resident and Sprintax confirms you are a resident – no further action is required at this moment

5. However – If Sprintax finds that you are a nonresident then you should have filed as a nonresident – you need to prepare and send an amended tax return (1040X) to the IRS to correct this

6. Sprintax will help you prepare your amended return, for any year

- We recommend you do this as quickly as possible

- Once you have your Sprintax amended return, mail this to the IRS.

- Separate from your amended return – return the stimulus payment. Instructions from the IRS

5. Future possible implications:

- Filing an incorrect tax return may cause fees and penalties to accrue with the IRS.

Incorrect tax filing will also impact a change of visa status or a future visa application – so please ensure now that you have prepared your taxes correctly for 2020 and previous years.